Senior Living Management Case Studies

12 Oaks Success Stories

12 OAKS SENIOR LIVING OUTPERFORMS INDUSTRY BENCHMARKS IN 2023

With a people-first approach, training and support from our corporate team, and the seamless integration of the Aline CRM and Sherpa sales process, 12 Oaks managed communities outperformed multiple industry benchmarks in 2023.

STRATEGIC ONBOARDING OF A MULTI-COMMUNITY PORTFOLIO IN TEXAS

In the spring of 2023, 12 Oaks Senior Living was chosen by Monticello as the management company to assume operations over a multi-property portfolio of assisted living communities scattered throughout North, Southeast, and West Texas.

COPPER CANYON

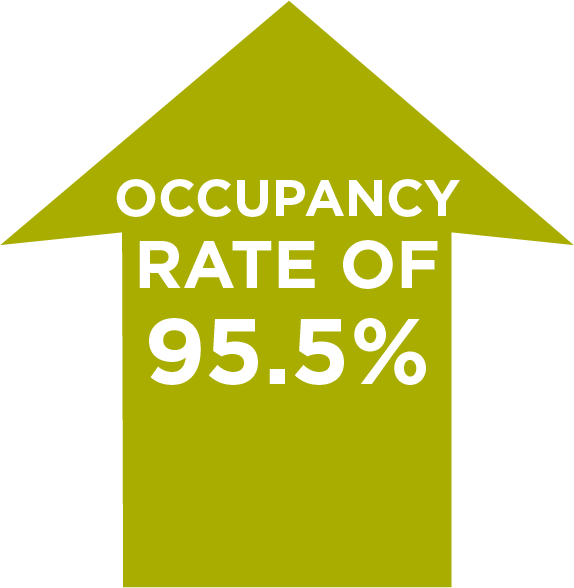

Witness the impressive transformation of Copper Canyon Memory Care and Transitional Assisted Living in Tucson, Arizona. In just six months, it went from 80% to 95.5% occupancy. 12 Oaks Senior Living shares the sales and marketing strategies that drove this success.

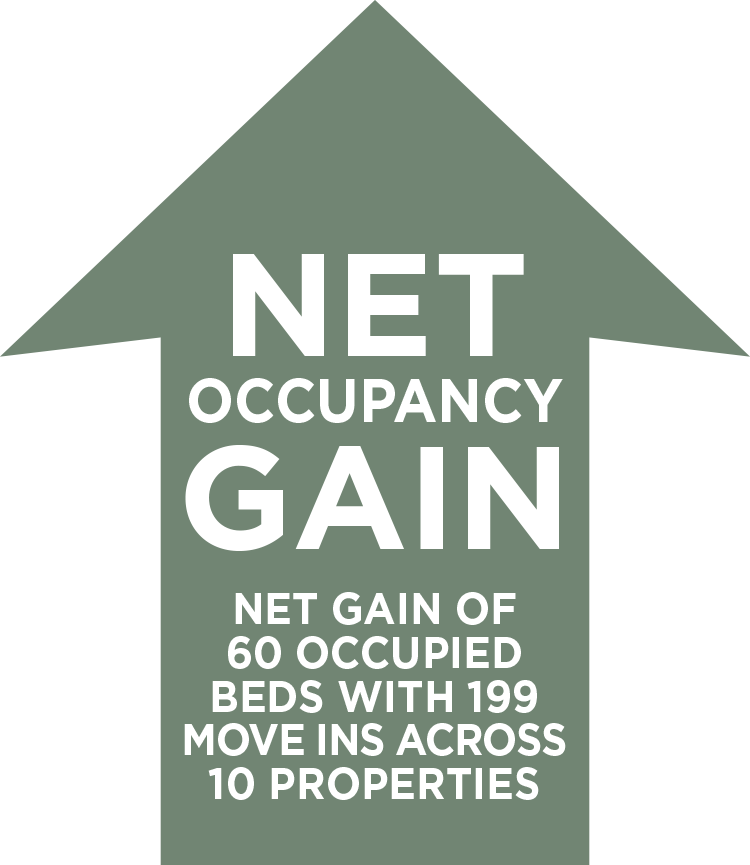

LEASING AND MARKETING SPRINT

Like many senior living operators, 12 Oaks Senior Living communities were not immune to the negative impacts of COVID-19, most significantly, decreased inquiries and confusion amid an environment of unfavorable public sentiment and fear. The result was a decrease in occupancy for several consecutive months in early 2021. This occupancy decline, combined with restrictions to community access, internal lockdowns, restrictions on staff and resident movement, and attempts to mitigate COVID-19 exposure within the communities, resulted in discouraged staff who were displaying signs of burnout.

BAYTOWN, TEXAS

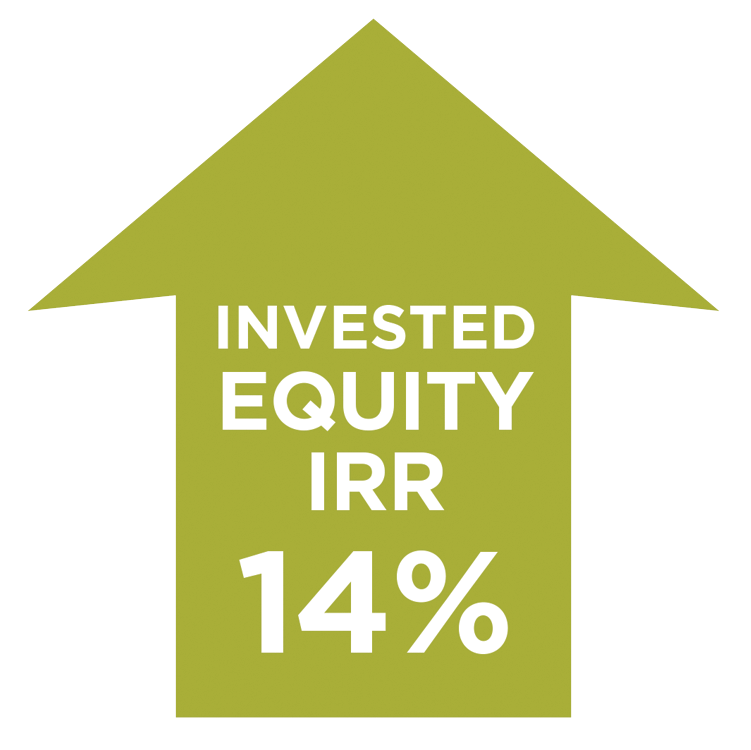

In 2007, 12 Oaks formed a venture company to acquire a senior living community in Baytown, Texas for 12.3 million dollars. The community offered 90 Assisted Living units ( Type A license) and 14 AL units (Type B). 12 Oaks recognized an opportunity to expand and remodel the existing community, create a more profi table service model, increase annual net operating income then sell for a profit.

EL PASO, TEXAS

In January 2012, an investment group purchased an underperforming portfolio of four communities in El Paso, Texas. The opportunity represented a portfolio of 387 beds across four communities involving independent, assisted living and dedicated memory care. Due to an established relationship based on proven performance, 12 Oaks was selected as the senior living management company for the communities

BROKEN ARROW, OKLAHOMA

In June 2018, 12 Oaks was engaged by ownership as the senior living management company for a 105-unit Assisted Living and Memory Care community in Broken Arrow, Oklahoma. The property was suffering from a slow lease-up trajectory in an overbuilt market under previous management.

LONGVIEW, TEXAS

A venture company acquired this uncompleted 209-unit Independent Living, Assisted Living and Memory Care community out of bankruptcy in Longview, Texas. 12 Oaks was engaged as the senior living management company for the pre-opening, lease-up and ongoing operations of the community. Upon completion of construction of the Independent Living portion, operations began on site in September 2017. Construction and licensing of the Assisted Living and Memory Care portions were subsequently completed, and those buildings opened in April 2018.